An investment portfolio is a tool that’s used to achieve your financial goals. That’s why a good adviser will always spend considerable time understanding your situation first. No two people are identical, and neither are their portfolios. The markets are the same for everyone, but how you interact with them is unique to you.

The interesting thing about hourly advice is that I speak with a couple of new clients every day and review their entire portfolio. Overwhelmingly, clients who are well-read and organized have the best portfolios because they are simple, low-cost, diversified, and tax-efficient.

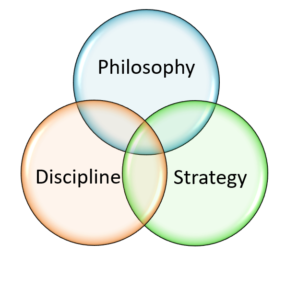

I believe successful investors possess three attributes. They have a sensible investment philosophy, develop a prudent strategy for their needs using low-cost funds, and stick to their plan with die-hard discipline. It takes all three traits to succeed long-term.

Embrace a Passive Philosophy

Embrace a Passive Philosophy

Philosophy is an investor’s underlying core belief about how markets work and how to best invest in them. The two main philosophies are active and passive. Active investors believe there is enough inefficiency in market prices to profit from trading after all costs. Passive investors believe the markets are more efficient than they are at determining prices and accept a market return through index-tracking investments.

The academic evidence is overwhelmingly in favor of passive investors. Those who accepted market returns have performed meaningfully better on average than active investors who try to outperform the markets. After structural costs (fees, expenses, commissions) and behavioral costs (poor security selection and timing errors), the net result of active investors falls far short of passive returns.

I believe passive investing works best for most people. My belief is based on years of study and three decades of direct experience working with thousands of investors. The Aha! moment for me occurred in the 1990s when I worked as a Wall Street stockbroker. Each quarter I would calculate the performance of every client’s portfolio and benchmark their performance to appropriate market averages. I was struck by the large gap that persisted between investor performance and the returns of the markets. My analysis led me to discover fundamental flaws in the way most people invest.

Create a Portfolio Strategy

Strategy puts philosophy into practice. The opportunity to earn market returns extend to every person and organization; however, no one strategy is universal. Strategy is the unique way each investor personalizes the universal passive philosophy. Every investor should customize their portfolio to their own needs and ability to handle risk.

Strategy starts with an assessment of your financial situation, long-term goals, and ability to withstand short-term losses. This leads to a prudent asset allocation among risky assets, less risky assets and risk-less assets, and to an asset location plan for tax purposes when applicable. From there, a portfolio of index funds and ETFs is constructed to achieve market returns in each asset class. These products offer low-cost, full transparency, tax efficiency and can be traded anytime. This process is discussed in detail in my books and other writings.

Quality investment advice from a professional may be helpful at this stage. Fees are important when selecting an adviser, but what’s more important is being on the same page philosophically first, then work together to find the best portfolio strategy.

Maintain Discipline

Maintaining discipline is the hardest part of investing. Distractions are everywhere. Adjusting a portfolio to keep up with the “news” is futile. Poor relative performance usually results when an investor attempts to trade on information that’s already known and widely disseminated in the marketplace. It’s easy to get caught up in the hype and break discipline, even as an index investor.

There are ways to improve discipline. One way is to keep your portfolio strategy simple. Less complexity means less temptation to make frequent changes. Holding a few, low-cost, broadly diversified funds in a portfolio helps maintain discipline. Core-4® Portfolios offer some good examples.

Investing in a single balanced index fund is another way to stay disciplined. The portfolio allocation is managed among different asset classes inside a balanced fund. All an investor has to do is select the fund with a proper allocation for their needs and put the money there. Everything else happens automatically.

A qualified adviser and personal portfolio management service can also help maintain discipline. An as-needed adviser provides assurance and assistance to a do-it-yourself investor. For those who prefer someone else do it, the fee for personal portfolio management has come down considerably in the past 10 years due to competition and technology advances.

Three Keys to Success

Philosophy, strategy, and discipline are the keys to long-term investment success. Once you’ve crossed the bridge to passive investing, select a few low-cost index funds that match the returns of the markets, and do whatever it takes to remain disciplined.